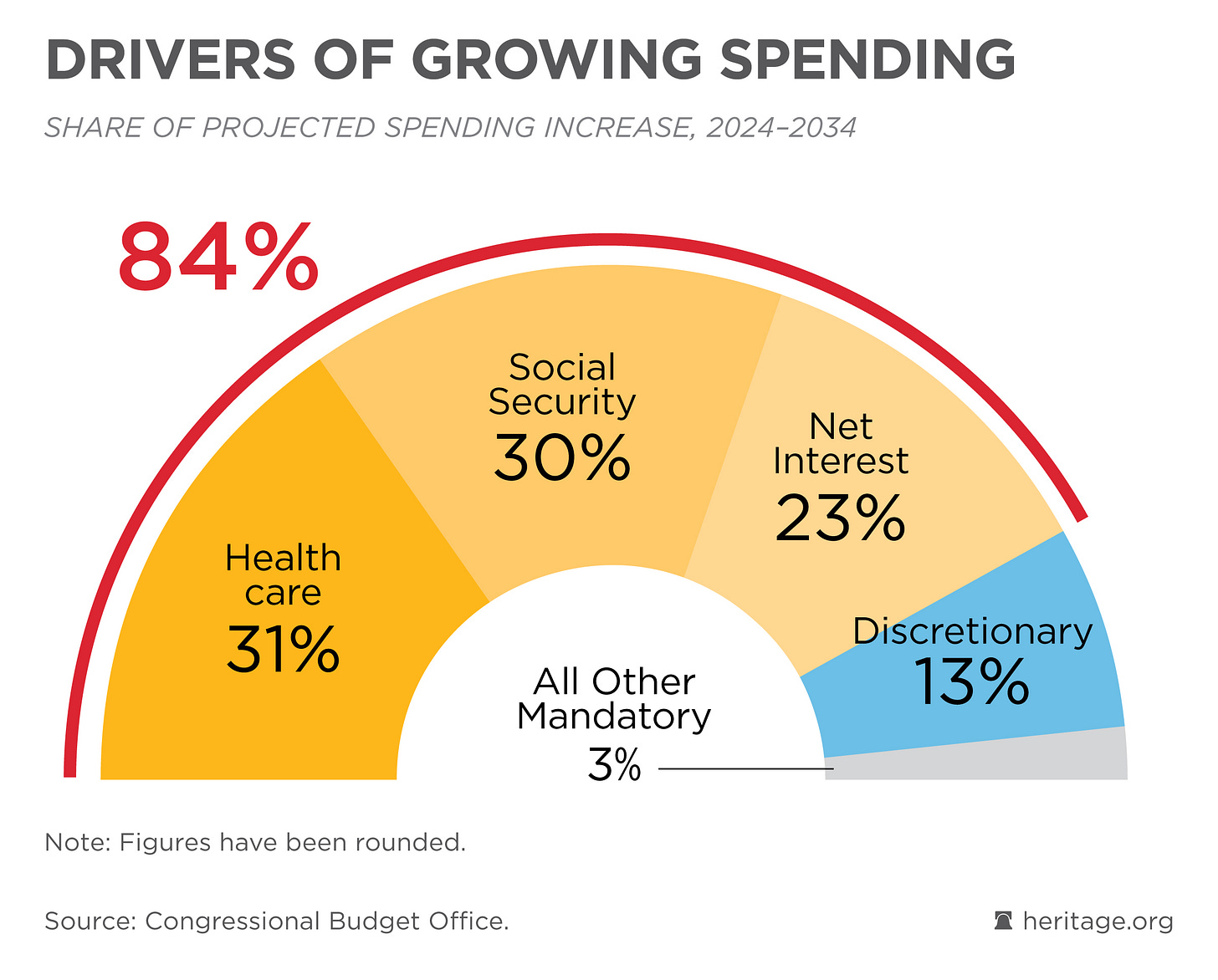

The $7 trillion federal budget, up from $4.2 trillion in 2019, underscores unsustainable federal spending. Spending, pitched as “stimulus,” distorts markets and crowds out private investment. Massive perpetual debt, or a private sector capable of efficiently reallocating resources, lays bare the ignorance and/or lie that federal spending is anything other than a redistribution tax.

US inflation, the most regressive tax of all, grows from federal spending and devaluation of our currency (printing money). Elon Musk claims economic growth is the solution to our budget crisis. Musk repeatedly emphasizes pro-growth reforms over spending.

Fiscal discipline is essential for growth. In February, Musk posted on X, “With support of the President, we can cut the budget deficit in half…then, with deregulation…we need to free the builders of America to build.”

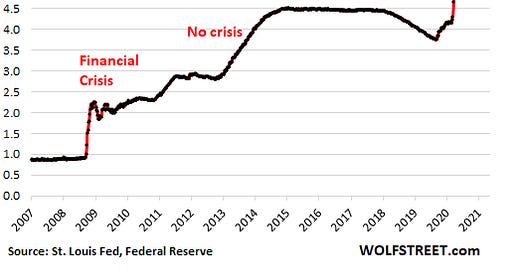

Federal spending is not pro-growth unless it is offset by larger reductions. Debt-financed expenditures redistribute resources without creating wealth and often lead to inflation or higher taxes. The over $5 trillion COVID lockdown “stimulus,” funded partly by quantitative easing, contributed to 2021’s 9.1% inflation rate peak. Inflation is the most regressive tax: it eroded real wages and staple affordability. Musk’s focus on deregulation—removing barriers to innovation—aims to unleash private sector potential, as seen in his push to ease environmental and labor regulations through DOGE.

Pro-growth strategies—tax cuts, deregulation, spending reductions, private sector human capital investment, and innovation incentives—offer the best path to prosperity. The private sector, not the government, drives economic expansion.

Governments in largely private sector health care states provide complete coverage at a much lower rate than the US federal and state rate of 24% of GDP.

Switzerland’s federal government spends approximately 0.8% of GDP on healthcare, focusing on subsidies and regulation, with total public spending at 7.7% GDP. Singapore’s government spends about 2.9% of GDP on healthcare with superior results.

Excessive regulation is a tax on the economy, costing the U.S. an average of 0.8 percent of GDP growth annually since 1980. The U.S. economy could be over 50% percent larger today. The United States ranks 27th out of 35 countries in product market regulation (which measures whether regulation encourages competition and ensures a level playing field).

This costly regulatory burden falls hardest on small businesses and entrepreneurs: business’ costs have increased 171 percent, after inflation, since 2000, a rate of 6.9 percent each year, or nearly 300% the rate of US economic growth.

In 2000, completing paperwork for Federal regulation cost an estimated $236 billion. The cost of paperwork increased to $881 billion in 2015 and $1.4 trillion in 2024.

The burden of government regulation falls most heavily on low-income Americans, who spend a larger proportion of their income on heavily regulated goods including education, transportation, gasoline, utilities, food and healthcare. The poorest households experience the highest overall levels of inflation and price volatility.

In EU countries that cut regulatory costs by 25 percent, real GDP went up by 1 point annually. Investing savings into research and development spending, the growth effect was 1.7%. When a country moves from the most-regulated quartile to the least-regulated quartile, its annual rate of growth can increase by up to 2.3%.

Eliminate costly regulations, such as EPA emissions rules ($1.134T lifetime) and Dodd-Frank financial oversight ($24–$36B annually), to reduce compliance burdens. Streamline permitting to accelerate infrastructure and manufacturing growth.

If Speaker Johnson brings separate spending bills and DOGE recissions to the floor (instead of omnibus/CR), President Trump can veto bills individually. This would give President Trump flexibility to reduce wasteful spending without threatening a shutdown.

Legendary economist Art Laffer believes a 15 corporate and income tax rate creates a “US driven flywheel of economic prosperity.” Bonus depreciation for business investment and a 100% R&D tax credit will lift growth. Laffer predicts a 2% annual GDP boost from 2017 tax cut permanence and reduction to 15%.

Eliminating taxes on tips and overtime, as proposed by Trump, could add $250–$500 billion in economic activity. Streamlining permitting could accelerate infrastructure and manufacturing growth

Help the private sector reform educational focus on literacy and STEM, as seen in Mississippi’s literacy program, which could yield $32 in earnings per $1 spent.

Privatize and expand the Manufacturing Extension Partnership (MEP). In 2024, the MEP generated $15 billion in new/retained sales, $5 billion in new investments, $2.6 billion in cost savings, and supported 108,000 jobs, with a return of $24.60 in new sales per $1 of federal investment. Since 1988, MEP has generated over $150 billion in sales growth, $15.7 billion in cost savings, and 797,994 jobs, per NIST. In FY2023 alone, it added $16.2 billion in sales, $2.9 billion in cost savings, and $4.8 billion in investments.

Trump’s $5,000,000 instant citizenship pass idea is genius: Hong Kong on the Hudson, or in Hawaii, or on the coast of the Gulf of America, or…

Incorporate a cost impact analysis review of federal regulations and launch a full regulatory review.

Streamline the whole permitting process: cut timelines and eliminate duplicative reviews. We rebuild our industrial base and secure true energy independence, by transcending inefficient federal choke points: environmental impact reports, hiring/zoning stipulations, and non-competitive contractor bids.

We’re just getting warmed up. Please share and discuss all pro-growth ideas in comments.